Making the migration to IP-based Networks

"Mr. Watson, come here, I want you."

The Public Switched Telephony Network (PSTN) has come a long way since those immortal words were spoken by Alexander Graham Bell to his assistant Thomas A Watson during a test of a telephone call in a Boston laboratory in 1876. Today, the PSTN remains the most widely used network in the world for the provision of legacy telecommunications services.

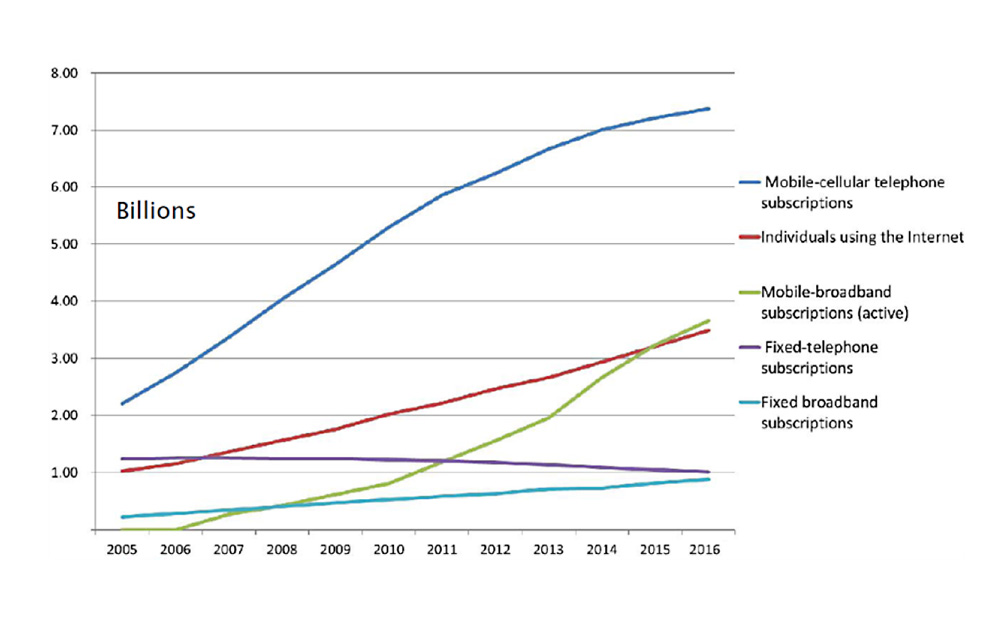

The world continues to evolve however, and voice communications is now just one of a suite of services that can be delivered across global electronic communications networks. Consumer demand for voice services, particularly fixed line voice services, has continued to decline in recent years. Moreover, the consumption of voice and SMS services provided vertically by the traditional telecommunications operators continues to decline as consumers increasingly adopt a variety of new and innovative communications services such as WhatsApp, Viber and Facebook Messenger, which offer voice, video and messaging capability.

Figure1: Global ICT Subscriptions (Source: Neotelis)

Figure1: Global ICT Subscriptions (Source: Neotelis)

The shift to IP: Demand for additional services, higher speeds and better quality

During the 1990s when internet access first came to the mass market, the PSTN became the gateway to the World Wide Web. Web services were basic and bandwidth speeds limited. As investors and industry stakeholders began to recognise the demand for faster networks to support an evolving and increasingly bandwidth-hungry suite of services, capital flowed into the telecommunications industry and the main players began to position themselves for the business opportunity. This need for greater capacity and support for multiple services resulted in ambitious plans for a shift towards all-IP networks. Circuit-switched networks (PSTN/ISDN) began to be migrated to a new architecture called Next Generation Networks (NGN) based on an all-IP platform (namely IP multimedia sub-system (IMS) with soft switches). The migration to NGN is a process in which whole or parts of the existing networks are replaced or upgraded to the corresponding NGN components. In turn, it provides additional services on a network capable of higher speeds and greater quality of service while attempting to maintain legacy services provided by the original network.

But is NGN not old news?

Yes and no. Since the exuberance of the late 1990s and the early signs of convergence between information and communications technologies (ICT), some seismic events have had a significant impact on investment in telecommunications networks. When the “dot.com” bubble burst in 2001 there was a flight of capital from the ICT industry. This, coupled with a collective hangover from buying very expensive 3G spectrum licenses, left the biggest telcos with a lot of debt on their balance sheets. This in turn had an impact on the world’s largest network equipment vendors resulting in a prolonged period of downsizing and consolidation in the industry. Nevertheless, while there were some major investments in migrating to NGN core networks in Europe, investment in next generation access (NGA) networks lagged behind despite efforts from regulators to increase infrastructure competition by stimulating investments. In 2006 and 2007 a couple of major technological breakthroughs, amongst other factors, rekindled the capital markets’ interest in telecommunications. They were: DOCSIS 3.0 and the introduction of smartphones.

DOCSIS 3.0 enabled cable operators to provide communications services on their networks, making it possible for them to provide a compelling triple play bundle of TV, broadband and fixed line voice. In fact, cable operators had a big advantage over incumbent fixed line operators as they were entitled to have access to incumbent networks, based on ex-ante regulation, to provide services in areas not served by their own networks. DOCSIS 3.0 represented such a disruptive threat to the traditional telco business that incumbent operators were required to act rapidly in order to remain competitive. This resulted in moves to invest heavily in access networks.

The introduction of another disruptive technology, smartphones, changed the way consumers engaged with communications services, which now required an almost constant online connection. The capacity needed for Wi-Fi hotspots and for mobile backhaul added to the business case for NGN and NGA investment to support this ever increasing demand.

The global financial crisis 2008-2009

"In stormy times, some people build shelters; others build windmills." (Chinese proverb)

Despite the business opportunities that were emerging, the industry was not immune to the global financial crisis of 2008-2009. Operator revenues were affected as consumers curbed spending and investment in capital projects slowed. However, the silver lining for the industry was that many governments around the world recognised the importance of the knowledge society for generating new forms of employment, and sought to implement, as part of their national programmes for government, “smart economy” strategies. Central to these plans was the need for investment in fast and reliable communications networks. Today, at least in the CEPT area, we are seeing the fruits of those plans in terms of investment in IP-based network infrastructure, with many countries having already migrated to all-IP or being well advanced in their migration projects.

ECC Report 265

In 2014, the ECC’s Working Group Numbering and Networks, through its Project Team on Technical Regulatory Issues (PT TRIS) started a project to look at the status of migration projects in the CEPT area. This was due to the fact that evidence of increased activity was noted in some countries. It culminated, on 31 May 2017, with the adoption of ECC Report 265 entitled “Migration from PSTN/ISDN to IP-based networks and regulatory aspects”.

The report is essentially based on an exchange of experiences in the regulation of migration toward IP-based networks and services between different CEPT countries - through their respective national administrations. The report also provides a status update on the migration process in some countries, and identifies various technical challenges. The report does not aim to mandate specific regulatory measures but may be used to inform future policies with the objective of providing a better understanding about the technical and regulatory drivers for migration. It may also provide some guidance on how this evolution will pave the way for the provision of multiple services on faster and more reliable IP platforms.

Drivers for migration: The operator perspective

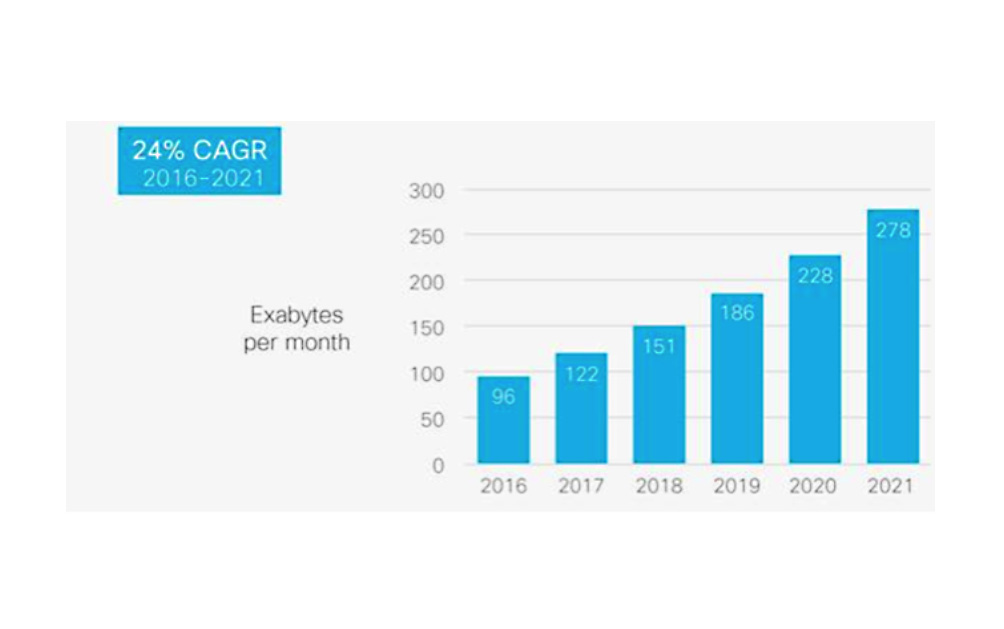

This article has already addressed the changes in how consumers engage with communications services, and how that engagement is driving the need for faster and more reliable networks to support data consumption. Cisco estimates a compound annual growth rate in data (exabytes per month) of 24% per annum for the period until 2021.

Figure 2: Global IP Traffic Forecast 2016-2021 (Source: Cisco)

Figure 2: Global IP Traffic Forecast 2016-2021 (Source: Cisco)

Notwithstanding the demand for data, there are other factors influencing operators’ migration strategies as detailed in ECC Report 265. These include:

- A limited and reducing supply of spare parts for legacy network elements;

- A reduction or cessation of vendor support for legacy network equipment and software;

- A dearth of expertise and experience in maintaining legacy networks caused by the retirement of engineers with the requisite skills and experience to support legacy systems;

- Fewer customers for legacy services resulting in lower revenues, higher unit costs per service and higher maintenance costs per customer;

- NGN equipment that is both cheaper to purchase and to operate on a common platform for multiple IP-based service offerings.

Furthermore, the real estate cost of housing modern network equipment is much lower as the nodes have a smaller footprint. Therefore, operators with large amounts of prime real estate have an opportunity to fully realise the value of this extra space by migrating to all-IP.

The report also evaluates the various options for migrating customers where different access network technologies are used. These include:

- Full migration – where the access network technology has been fully migrated (e.g. fibre-to-the-home (FTTH));

- Emulation of legacy services using technology such as multi-service access nodes (MSAN);

- Migration to the core-IP network using broadband ports.

Regulatory obligations

While the operator’s core concerns are to reduce costs, increase revenue and remain competitive, they must also take account of their regulatory obligations in their respective migration strategies. Such obligations include: maintaining access to emergency services; supporting number portability, and ensuring an enhanced customer experience through the provision of superior products, better customer service and shorter time-to-market with higher speed and less latency.

One key finding of the ECC Report 265 was the need for operators to raise awareness of migration projects with their customers and to provide advance notice and regular updates throughout the process in order minimise the risk of any potential disruption.

Dealing with disruption

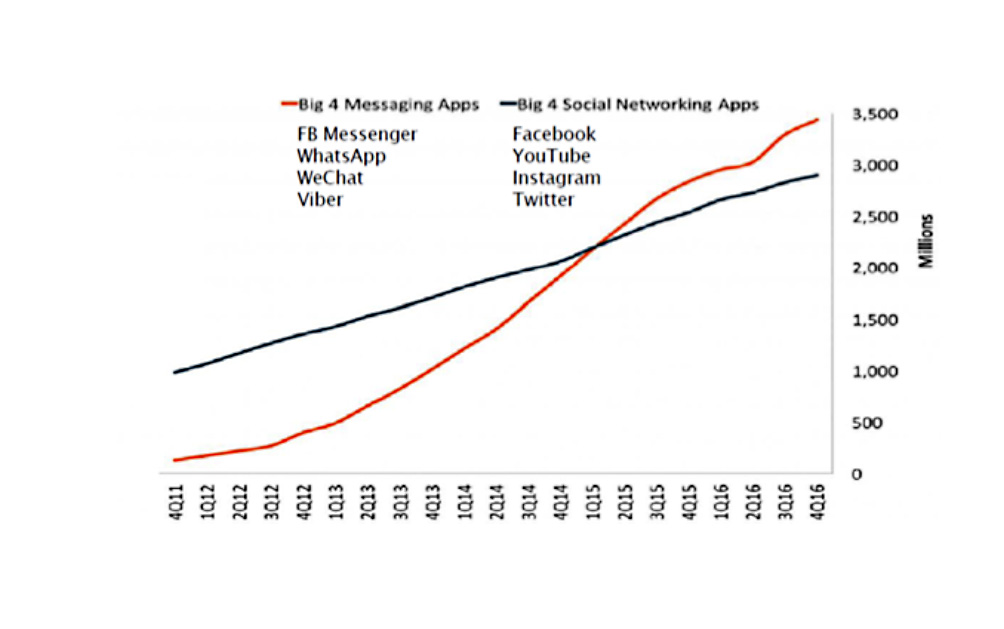

Against the backdrop of disruptive competition from over-the-top (OTT) players (such as Google, Facebook and Netflix), migration poses some significant challenges. Ultimately OTT players will benefit the most from increased network investment and faster speeds. Since 2011, the user base for the four largest social media apps is now approaching 3 billion users globally while the user base for the four largest messaging apps (which all support voice and messaging) approaches 3.5 billion users globally.

Figure 3: Monthly active users of top 4 social media and messaging apps (Source: Neotelis and BusinessInsider.com

Figure 3: Monthly active users of top 4 social media and messaging apps (Source: Neotelis and BusinessInsider.com

As existing operator revenues are eroded by OTT competition they will need to adapt and be innovative in order to fully monetise their investments. Regulators will also need to have the flexibility to adapt to this new competitive landscape where attention will need to be given to net neutrality, data security and privacy, as well as to the existing regulatory objectives of competition and consumer protection.

From a technical regulatory perspective, equivalents to the existing suite of wholesale network inputs will need to be provided for, and IP interconnection will become an area of increasing interest for regulators in the short term. The diversity of types of IP interconnection, of signalling protocols and codecs will require a harmonised approach and broad consultation among key stakeholders.

In conclusion, regulators must strive to strike a balance between fostering competition and consumer choice while stimulating network investment in the coming years. Equally, market players will need to strike a balance between earning a reasonable rate of return on their network investments while meeting emerging customer demand for services that require faster and more reliable networks.

It will be interesting!

ECC Report 265 is available at the ECO Documentation Database - http://www.ecodocdb.dk/

Freddie McBride, Expert in Numbering & Networks, European Communications Office